5 minutes estimated reading time

Opportunities for brand communications – 2016 has been a watershed year in the western world. Political forces that were simmering, but previously untapped manifested themselves in populist victories. Political norms that were common currency for the past two decades have been brought into question and there will be societal impacts and changes in consumer tastes.

Businesses are being buffeted by these changes and so will their business. In the case of the UK; supply chains will be re-engineered over the next two years to address the country’s departure from the European economic bloc. It will mean recalibrating the values of some brand communications. Most companies that I have spoken to are working on the assumption of the hardest Brexit:

- No trade agreement with the EU

- No customs union with the EU

- No passporting for services such as banking

- No agreement on storage of EU or US personal data in the UK

- No free movement of EU talent

- Problems with the WTO as countries look to settle scores like ownership of the Falkland Islands and Gibraltar

This presents brand communications teams with opportunities and challenges:

- There will be new regulatory and legal environments for companies to navigate

- Corporate and social responsibility programmes will need to be recalibrated

- There will be change management as jobs are moved abroad and facilities closed

- Brands will have to work smarter with less

- Consumer data based systems will need to be redesigned to meet the new legal and country boundaries imposed upon it

- UK businesses will need to prepare for permanent handicap on their profits

There is also a wave of change for consumer businesses. Whole categories of products – carbonated drinks, cereals and spreads are losing market share to substitute products. This is hitting the large FMCG (fast-moving consumer goods) brands including:

- Unilever

- Coca-Cola

- General Mills

- Nestle

- Kelloggs

Consumer brands have looked to counteract this in a number of ways:

- Putting their spend where it will do the best work by using zero-based budgeting (ZBB)

- Restructuring brand architectures – moving away from preventing brand damage through brand extension to brand consolidation to maximise the benefit of marketing spend. Coca-Cola is a prime example of this

- Brand architecture will create a tension in the organisation. On the one hand the societal norm will be for local brands rather than global, on the other you have the corporate desire to cut and simplify to maintain margins. Whilst some companies may kill brands, others may sell them on to local companies, which will then try to squeeze as much value out of the brand equity as they can

- Move away from micro-targeting to ‘smart’ mass-marketing – the key exponent of this is Byron Sharp at the Ehrenberg-Bass Institute at the University of South Australia

Opportunities in terms of new products that communications agencies can offer

- Internal communications programme – site shutdown or company shutdown as a product

- CSR audit as product

- CRM (customer relationship management) audit as product

Brand communications vs. ZBB

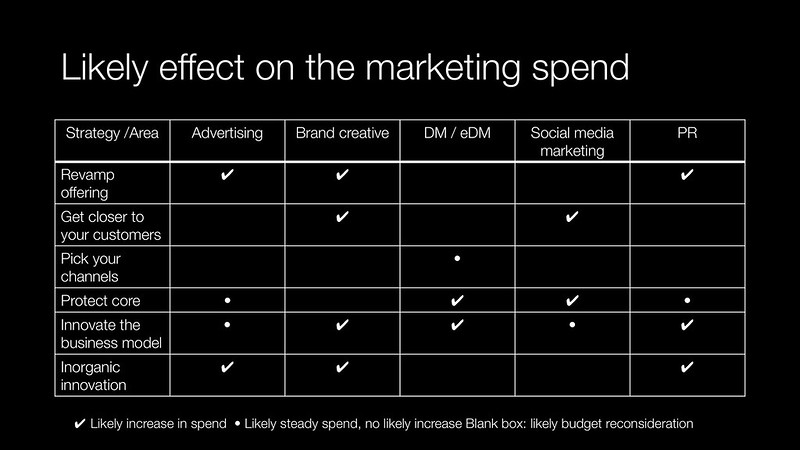

Focus on clients based on their strategic intent if they are implementing ZBB, here’s a quick guide I did earlier this year.

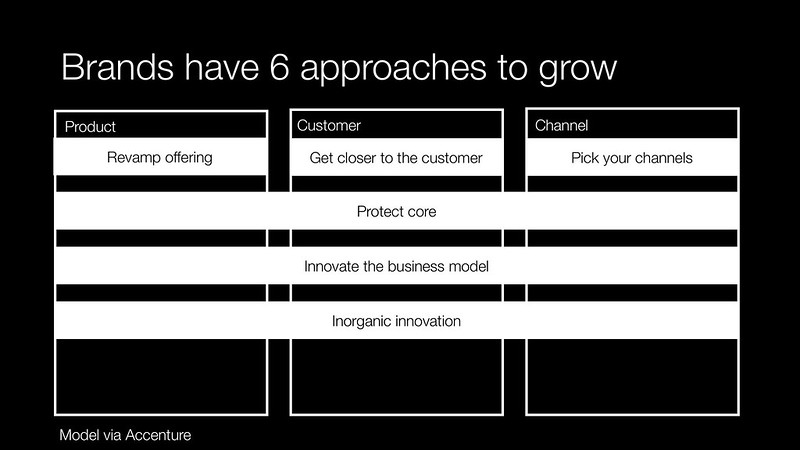

Businesses have six paths to growth

If your client programme lies in parts of the spectrum where you won’t benefit, then as an agency you have a few choices:

- Identify and grow your business within other brands of a clients business

- Look at rivals for opportunities

- Treat the current business as a cash cow

Effect of agency consolidation on brand communications

A second aspect of risk analysis is brand consolidation. There is not much that an agency can do with the change in brand architecture like Coca-Cola. The clients are likely to cut costs.

A clearer source of risk will be ‘local gems’ this is a consumer brand that is only sold in one country (it may be known under a different name in other countries). These brands are likely to be closed down or sold on, particularly if they are in declining growth sectors such as margarine spreads, cereals or carbonated drinks.

If you have only started planning about looking for replacement brands in your portfolio, it may already be too late. Best case scenario is that the brand is bought by a local FMCG company.

Looking at previous brand sales like Radion washing powder as an example the acquirers will not support it with significant marketing spend. Instead, they will look to maximise their investment by mining existing brand loyalty and awareness. Depending on the product category and the target audience will depend on how fast inevitable brand decline will be.

Either way it is not a particularly attractive piece of business or large or medium-sized agencies. An incumbent agency will have to repitch for the work as it will fall outside the purview of existing contracts and business relationships.

Advertising agencies have a head start in terms of their planners having a clear grip on what Sharp’s concept of smart mass marketing means for their discipline. PR agencies need to articulate this and reflect it in their account planning. They are still struggling to get to grips with social and are championing concepts like ‘micro-influencers’; that don’t fit into Sharp’s world view. They are effectively burning client respect.

PR agencies need to think much more in terms of programme audience reach and repetition for audiences, rather than the current focus on influence. More marketing related content here.