Will supply chain technology facilitate problematic global supply chain management?

Investors Are Piling Into Supply-Chain Technology – WSJ – Newly minted unicorns, or companies that exceed $1 billion valuations, in the logistics sector in 2021 include e-commerce fulfillment specialist ShipBob Inc., digital warehouse and distribution provider Stord Inc. and Flock Freight, a platform that matches shipper loads to trucks and is backed by a venture arm of Japan-based conglomerate SoftBank Group Corp. Backers including big investment funds are pumping money into logistics technology at a rapid pace, driving up valuations for digital-focused ventures across freight, delivery and warehousing. The influx of cash is giving startups in a once-overlooked sector expanded access to capital to build out their businesses, particularly for the top companies that have already developed their core products, according to venture-capital executives who focus on logistics and supply chains. Supply-chain technology startups raised $24.3 billion in venture funding in the first three quarters of 2021, 58% more than the full-year total for 2020, according to analytics firm PitchBook Data Inc. Besides venture-capital firms, backers included global investment managers like Tiger Global Management LLC and Coatue Management LLC and the venture arms of large corporations such as shipping giant A.P. Moller-Maersk A/S and Koch Industries Inc. And then you have Venture capitalists chase industrial tech start-ups as supply shocks widen | CNBC – this reminds me of the B2B dot com frenzy around companies like GoIndustry, i2 Technologies and JDA Software / Blue Yonder.

Supply chain technology underpins supply chain management (SCM). SCM as a term sprang out of management consultancy Booz Allen Hamilton in 1982. But the originals of supply chain technology go back much further. Railway companies were experimenting with barcode type readers with British Rail having a system that read the codes on trains passing at 100mph error free. This system was eventually shut down when British Rail was privatised. In the US they were using KarTrak in the late 1960s, but that was later abandoned. The codes were incorporated into the computer software used to schedule freight rail transport. Shipping containers sprung out of work done for the US military and were proved successful in Korea. The standards for the ‘intermodal’ container where hammered out from 1968 through 1972 covering everything from the containers themselves to safe handling. So you had a standard box and a method of tracking it, which is at the core of supply chain technology.

Containers did a number of things:

- It helped prevent ‘shrinkage’. Seiko no longer had to worry about shrinkage due to dockers kicking in the corner of a crate to steal a watch or ten and sell them down the pub.

- It encouraged automation of docks and handling, reducing the amount of unskilled labour required

- Simplified freight forwarding and handling through standardisation

- Facilitated easier global supply chains. Goodyear would know how many tractor tyres it could fit in a 40 foot trailer and ship from Singapore. The ports of Singapore and Hong Kong managed to parlay their use of logistics management software to move containers faster, which proved to be a competitive advantage for a number of years, even after Hong Kong deindustrialised with the mainland opening up

Once logistics management was in place, attention could be turned to sourcing, procurement and the integration of enterprise resource planning to provide an end-to-end picture through supply chain technology. The Japanese developed a lot of management practices designed to master supply chain management and these practices drove a wider demand for supply chain technology.

Packet network infrastructure provided a way to connect systems from channel partners, intermediaries and third party suppliers with a company through a standard interface for supply chain technology to work. What is called EDI or electronic data interchange. The rise of the web made it even easier which is why you had a plethora of supply chain technology companies to simplified the process of EDI. They democratised supply chain technology.

It also allowed retailers like Tesco to use supply chain technology to become vertically integrated from upstream suppliers and downstream customers.

China

Ex-President of China Merchants Bank Investigated for Suspected Corruption | Caixin Global – China Merchants Bank is huge. Londoners might be familiar with the brand from the extensive advertising CMB have done aimed at Chinese tourists every summer since the Olympics. Scandals are also changing marketing: Why Are Athletes Becoming Luxury Brands’ Ambassadors of Choice in China? – problem is due to show business stars reputation from being effeminate looking men to corruption, tax evasion and sex abuse scandals like their business titan peers

Divergent views on China’s investment landscape | Financial Times – JPMorgan last month called China’s internet sector, once an engine of growth, “uninvestable”. Many big investors have headed for the exits. This week we revealed that Weijian Shan, the chair of PAG, a $50bn fund and one of Asia’s biggest investors, has diversified away from China.

Consumer behaviour

UK consumer confidence plunges to near-record low | Financial Times

Culture

Terence Donovan captures the hedonism of Birmingham’s ’90s… – The Face

Design

Ethics

The age taboo in workplaces means we miss out on talent | Financial Times – Research by two Harvard psychologists, Tessa Charlesworth and Mahzarin Banaji, suggests that negative stereotypes of ageing are actually more persistent than those about race and gender. Drawing on data from more than 4mn tests of conscious and unconscious bias, they have found that attitudes to sexual orientation, race and skin tone have improved during the past decade, compared to stubborn biases about age and disability, and increasing negativity about people who are overweight. Charlesworth and Banaji predict that anti-gay bias could reach “neutrality” in 20 years’ time, but that on current trends it will take 150 years for the same to happen to ageism. The raw reality is that older workers tend to be more expensive than younger ones, and are more vulnerable to cuts to middle management. But it may be a false economy to lower initial salary costs by hiring the young, if familiarity with procedures and teamwork are lost

FMCG

Investigating the Pink Tax: Evidence Against a Systematic Price Premium for Women in CPG by Sarah Moshary, Anna Tuchman, Natasha Bhatia :: SSRN – We find that women’s products are more expensive in some categories (e.g., deodorant) but less expensive in others (e.g., razors). Further, in an apples-to-apples comparison of women’s and men’s products with similar ingredients, the women’s variant is less expensive in three out of five categories. Our results call into question the need for and efficacy of recently proposed and enacted legislation mandating price parity across gendered products. – so there is actually a ‘blue tax’ rather than a pink tax

Hong Kong

The Black Box: My Experience in Hong Kong’s Prisons During the Pandemic Lockdown

Some Hong Kong women would rather die alone than date Hong Kong men — Quartz

Ideas

On Collaboration — Tom Darlington

British Historian Antony Beevor: “Putin Wants to Be Feared – Like Stalin and Hitler” – DER SPIEGEL – the liberal West is now facing a decline, and even possibly a collapse, in confidence in parliamentary democracy. The heroic resistance of Ukraine is perhaps the only hope that we will recognize in time the dangers of the general slide towards authoritarianism in an increasingly Manichaean world – that is to say, a new dualism of two power blocs confronting each other: one with a free and liberal stance, and one without.

The cognitive dissonance of corporate life | Financial Times – employers’ efforts to drag people back into the office by offering them “perks” from free snacks to company swag. One particularly eager (and rich) organisation offered workers who were willing to trek back in the chance to win a Tesla. But Spiers, like me, isn’t biting. “I’ve come to think of these corporate toys and rewards as the work equivalent of the cheap prizes you win at a carnival after emptying your wallet to play the games,” she writes. “The difference is that the point of the carnival is to have fun and the prizes are incidental. In the workplace, this is just a laughably terrible trade-off. Who wants to give up the two hours a day they gain by not commuting for a free coffee mug? – interesting challenge that probably only a recession will right

Digitally-Native Jobs, Self-Employment, and the Antiwork Movement

Indonesia

Indonesia’s new law removes redtapes for foreign investors | DigiTimes – With abundant natural resources and young labor, Indonesia attracts – and needs – more foreign investment. The three largest foreign investors in Indonesia are Singapore, China (including Hong Kong), and Japan. Data provided by Indonesia’s Ministry of Investment (BKPM) showed that in the first three quarters of 2021, Singapore accounted for 32% of the total foreign investment, Hong Kong 13.8%, China 10%, and Japan 7.7%. – its also a great option for the move away from Chinese manufacturing

Innovation

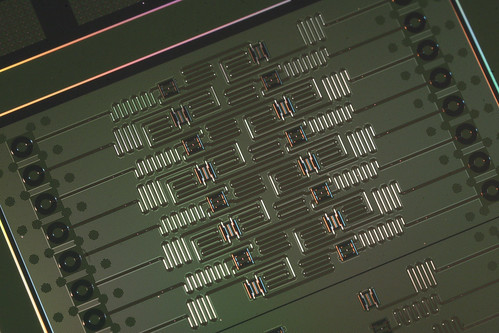

Bosch snaps up Fraunhofer MEMS microspeaker spinout – eeNews Europe

Korea

Young Rich Koreans Are Worth on Average W6.6 Billion – The Chosun Ilbo (English Edition)

Luxury

Kering: China’s lockdown takes much of the blame for Gucci’s crimped sales | Financial Times – I’d be more worried by how dependent they are on Chinese mainland sales

Crypto crackdown stifles China’s ability to offshore cash | Financial Times – With the government applying more scrutiny to digital asset transactions, one of the oldest and most conventional methods to bypass capital controls is gaining popularity: the luxury collectible trade. While it’s difficult to bring suitcases filled with cash through customs, a Tang dynasty-era vase or a couple of Patek Philippe watches can easily pass as personal belongings. Rich buyers can purchase them in China and resell outside the country. Indeed, demand for designer time pieces is taking off, high-end watch sellers in China told the FT. One wealthy Chinese heir also told the FT about another existing loophole, in which Chinese developers building condo projects in Thailand or Malaysia market them at home, and accept renminbi. Once properties are purchased, they can be sold locally into currencies that can be more easily exchanged into dollars – this probably explains why auction houses Sotheby’s and Phillips have expanded their Hong Kong operations

Media

Netflix is not a tech company — Benedict Evans – back in 1992, just as the ‘Internet’ was starting to sound interesting, a company in the UK used technology to disrupt television.

Rupert Murdoch’s Sky realised that you could buy football rights for far more than anyone had ever thought of paying before, and you could make your money back by selling the games on subscription instead of pay-per-view or advertising, and you would be able to deliver that subscription using encrypted satellite channels. This was a big deal, both for Sky and for the UK Premiership league, and it was the beginning of something much bigger.

Sky used technology as a crowbar to build a new TV business. Everything about how it executed that technology had to be good, and by and large it was. The box was good, the UI was good, the truck-rolls were good, and the customer service and experience were good. Unlike American cable subscribers, Sky subscribers in the UK are generally pretty happy with the tech. The tech has to be good – but, it’s still all about the TV. If Sky had been showing reruns of MASH and I Love Lucy no-one would have signed up. Sky used tech as a crowbar, and the crowbar had to be good, but it’s actually a TV company.

I look at Netflix in very much the same way today. Netflix realised that you could spend far more money on far more hours of scripted drama than anyone had ever spent before, and you could (hopefully) make your money back by selling it on subscription directly to consumers instead of going through aggregators, using a new technology, broadband internet, that both gave you that access and made it possible for people to browse that vast selection of shows – and this: Ads are coming to Netflix: What do top media buyers and analysts think? – It’s plausible that Netflix will play a key role in driving the roll out of hybrid AVOD/SVOD around the world. Today, such models are mostly found in the U.S. and in Asia, but should Netflix add this on a global basis, it could be the next big thing. It’d force others to move beyond pure paid-for streaming models. I’ve long argued that it is unsustainable to expect customers to buy more than five SVOD services — so hybrid models are part of the solution as it eases the pressure on consumer wallets.

Ad agencies have persistently asked Netflix over the last few years to start running ads on the service. But they’ve been firmly against this until now. However, as Netflix management said on the investor call, what has changed is that this is a proven model that works: Hulu, HBO Max and Disney+ are doing it, so of course

Online

Go beyond the search box: Introducing multisearch – this Google redesign reminds me of much of the experience in search pioneered by you.com. Google needs to reinvent its search offering, early adopters are finding it much less useful then previously – Google search engine is not up to the mark, irrelevant ads and spam disappoint users. Here’s all you need to know / Digital Information World

Security

France says Russian mercenaries staged ‘French atrocity’ in Mali | Mali | The Guardian

Singapore

Singaporeans must benefit’: expats fleeing Hong Kong meet rising resentment | Financial Times – Chia is not alone in holding anti-expat beliefs. Over the past decade, perceptions that international employers have discriminated against locals have placed increasing pressure on the government to clamp down on immigration. While some anger has been directed towards manual labourers from elsewhere in Asia, Singaporeans are also frustrated by the significant proportion of westerners that make up the city’s elite workforce. After the recession triggered by the coronavirus pandemic refocused attention on employment and inequality in Singapore, the discontent has intensified. Experts warned that an influx of white-collar staff from Hong Kong risked deepening tensions, complicating Singapore’s bid to attract foreign money and talent. – Singapore’s answer to populism?

Telecoms

EETimes – CAN FD: Anything But Automotive Only – controller area networking. Uses connectors including RS232

The military race for low Earth orbit satellites – and why China is behind | South China Morning Post – LEO satellite broadband projects going on in addition to Elon Musk’s StarLink – In Europe, Germany-based Airbus Defence and Space has teamed up with satellite internet firm OneWeb to provide services to the military. Canadian firm Telesat, partly funded by Ottawa, is eyeing the US Defence Department as a customer for its global LEO internet service, which is expected to start in 2024. Amazon’s Kuiper project also has been approved to launch 3,236 satellites but has been tight-lipped on its plans in the defence market. In China, LEO satellite internet is a fledgling industry working to connect remote parts of China and countries involved in the Belt and Road Initiative. GalaxySpace, a private start-up in a field of state-owned giants, launched China’s first LEO broadband constellation comprising six satellites in March. But state media reports have described them as commercial and made no reference to military services. Separate state-owned enterprises also launched test satellites for the Hongyun and Hongyan LEO broadband projects in 2018 but little has been said publicly about them since. Another state-owned company, China Satellite Network Group, aims to create a Chinese version of Starlink but was only formed last year

Web of no web

LVMH’s Arnault is wary of the metaverse “bubble”. Should luxury be? | Vogue Business