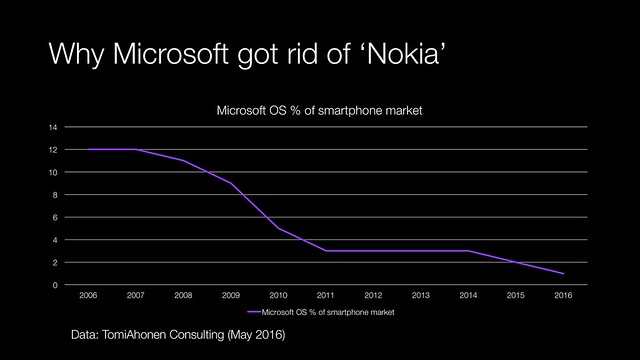

The New Nokia can rise from the ashes of the old. Microsoft finally let go of its licence for the Nokia brand license on May 19, 2016.

There is a lot of logic to this move:

- Microsoft has already written down the full value of the business acquisition

- It has got the most valuable technical savvy out of the team and moved it into the Surface business

- It removes problematic factories and legacy products

For the businesses that have acquired the rights to use the Nokia name and the factories the upsides are harder to see.

The factories may be of use, however there is over supply in the Shenzhen eco-system and bottlenecks aren’t usually at final manufacture, but in the component supply chain.

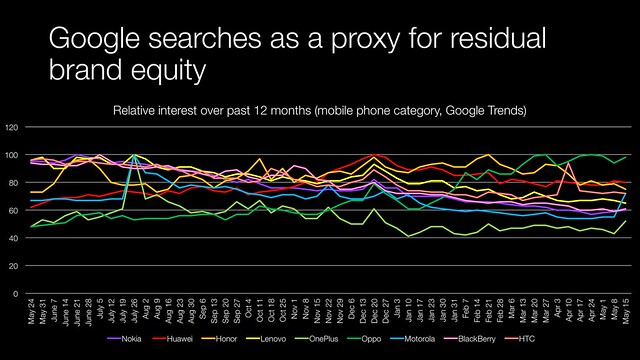

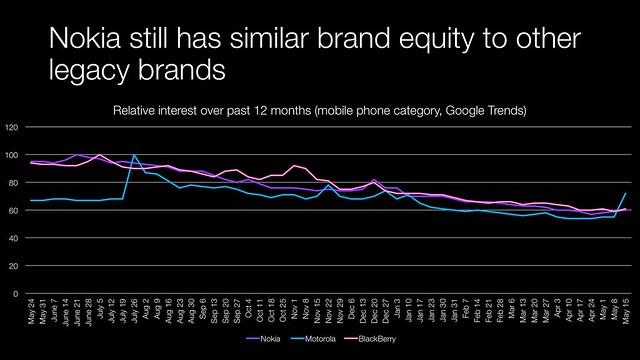

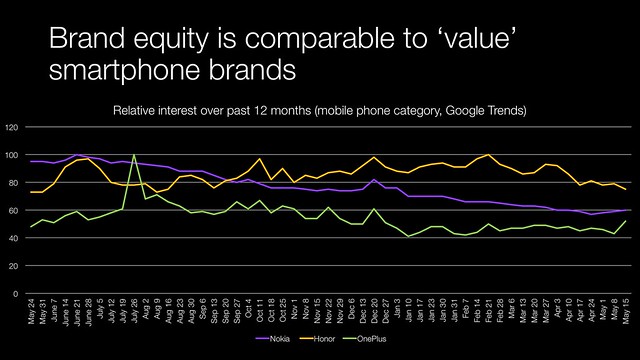

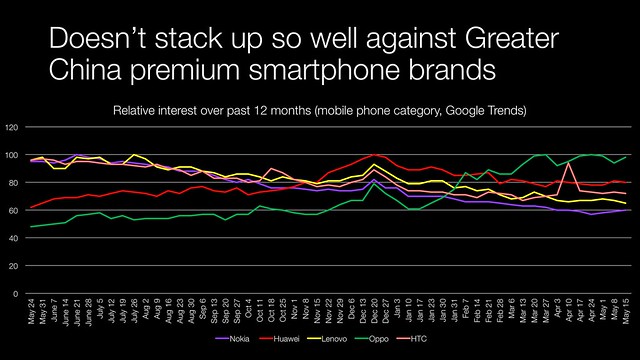

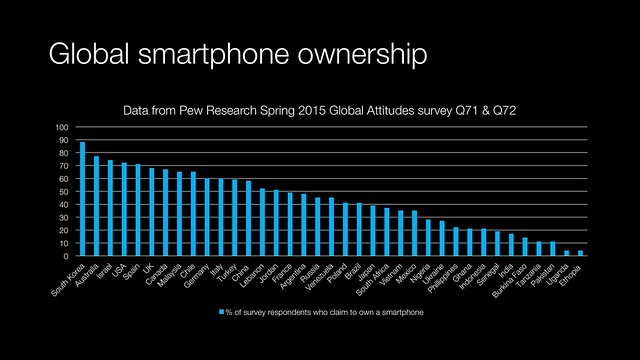

There is still some brand equity left in the Nokia phone brand. I analysed Nokia along with a number of other international Greater China smartphone eco-system brands using Google Trend data.

There has been a decline in brand interest over the past 12 months for Nokia of 37%

Nokia still has comparable brand equity to other legacy mobile brands such as BlackBerry and Motorola

The brand equity is comparable to other value mobile brands. Honor; Huawei’s value brand has had a lot of money and effort pumped into it to achieve its current position.

But it’s brand equity doesn’t stack up well against premium handset brands from Greater China. The reason for this is that smartphone marketing and fast moving consumer goods marketing now have similar dynamics – both are in mature little differentiated markets. Brands need to have deep pockets and invest in regular advertising to remain top-of-mind across as large an audience as possible. Reach and frequency are more important than social media metrics like engagement.

In addition to advertising spend needs to be put into training and incentivising channel partners including carriers.

They are entering a hyper-competitive market and it isn’t clear what their point of advantage will be. Given the lock down that Google puts on Android and commoditised version of handset manufacture, the best option would be to look for manufacturing and supply chain efficiencies – like Dell did in the PC industry. But that’s easier said than done.

Garnering the kind of investment required to seriously support an international phone brand is a hard sell to the finance director or potential external investors.

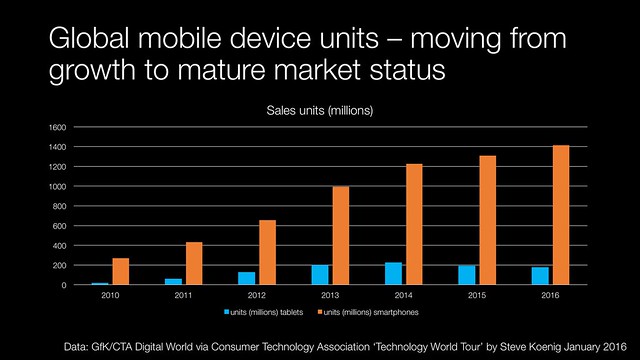

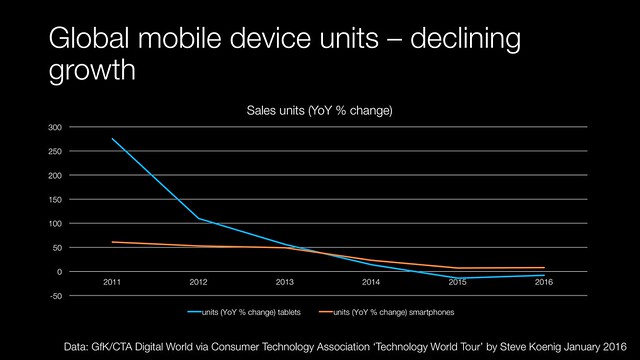

Growth is tapering out.

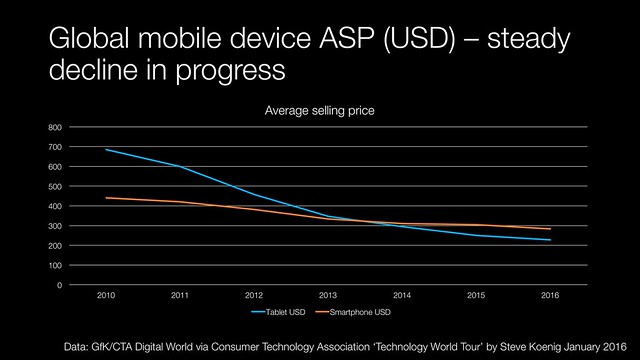

The average selling price is in steady decline

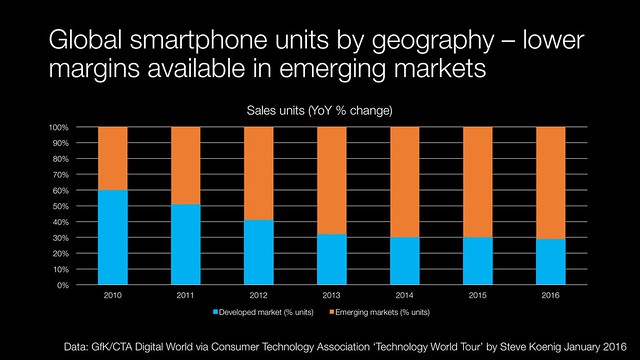

This is partly because the emerging markets are making the majority new phone purchases.

Consumers in developed markets are likely holding on to the their phones for longer due to a mix economic conditions and a lack of compelling reason to upgrade.

All of the consumers that likely want and can afford a phone in developed markets have one. Sales are likely to be on a replacement cycle as they wear out. Manufacturers have done a lot to improve quality and reliability of devices.

Even the old household insurance fraud standby of dropping a phone that the consumer was bored with down the toilet doesn’t work on the latest premium Android handsets due to water-proofing.

More information

The answer to the question you’ve all been asking | Nokia – Nokia’s official announcement

Gartner highlights a more challenging smartphone sector for Nokia than when it “quit” in 2013 | TelecomTV

Nokia is coming back to phones and tablets | The Verge

So the Nokia brand returns.. with a Vengeance | Communities Dominate Brands

Supporting data slides in full