The Irish race

An interesting documentary from 1971 that explores the idea of ‘The Irish Race’ – it is one episode in a 10-part documentary series ‘We The Irish’. It features some of Ireland’s leading public thinkers at the time including Conor Cruise O’Brien and Seán Ó Faoláin. ‘Race’ as a term is more problematic now than back then as there were so few Irish people who weren’t white European looking as Ireland was a next exporter of people rather than welcoming inbound migrants until recent decades. Secondly, the Irish people were constantly having to establish their identity, culture, language and accomplishments in the shadow of their former colonial rulers.

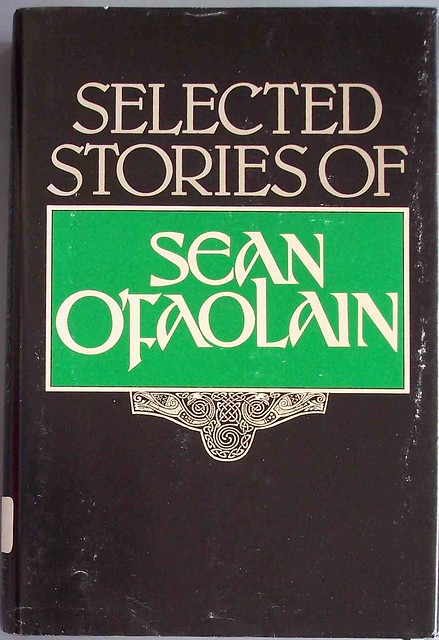

Ó Faoláin an internationally famous short-story writer, a key part of the Irish arts establishment and a leading commentator and critic – a role played by the likes of Fintan O’Toole today.

The discussion about the Irish race was an essential part of decolonising the Irish identity; by emphasising Irish distinctiveness and salience rather than reinforcing racial superiority. A process that countries like Singapore and Malaysia would wrestle with in subsequent decades too.

Ó Faoláin starts his discussion with the book Facts About Ireland that was published for over three decades by the Irish Government. The book itself is like a more in-depth version of the CIA World Fact Book profile on Ireland. It was available in souvenir shops up and down the country, my parents probably have my copy of the 1979 edition that I purchased from Salmon’s newsagent and post office in Portumna

O’Brien was part of the Irish elite. His father was a journalist for a Republican newspaper pre-independence and he married into the political establishment of the Irish Republic. But that shouldn’t take away from his achievements in the various facets of his career by turns was an Irish diplomat, politician, writer, historian and academic.

The series also marks a different kind of high brow factual television than we are used to seeing now.

Beauty

Superagers: a rare group who can teach us how to grow old gracefully | Science & Tech | EL PAÍS English – longevity will be where beauty meets health and wellness

China

The China 2023 series – by Noah Smith – Noahpinion – on Chinese economics

Work dries up for US consultancies in China after national security raids | Financial Times which makes it hard to do due diligence when doing the inward investment that China wants: China sounds out foreign buyout groups over boosting inward investment | Financial Times

The Case for a Hard Break With China | Foreign Affairs – U.S. theorists and policymakers ignored the potential risks of integration with an authoritarian peer. Globalization was predicated on liberal economic standards, democratic values, and U.S. cultural norms, all of which were taken for granted by economists and the foreign policy establishment – the arguments in the article are not new, what’s interesting is that they are being run in Foreign Affairs magazine and that should worry China

China secretly sends enough gear to Russia to equip an army – POLITICO

China’s new scientists | Chatham House – International Affairs Think Tank

Culture

Love Will Save The Day – Jed Hallam’s online radio station

Design

archives.design – beautiful graphic design inspiration

TUGUCA(ツグカ)|スノーピーク * Snow Peak – Snow Peak have their own shelving system which looks amazing

Economics

Book Review: “The End of the World is Just the Beginning” | Noahpinion – I will write my own review once I have read the book myself. It’s currently in my to do pile

The New York Tech Sector – AVC

China’s Government Offers Love, but Entrepreneurs Aren’t Buying It – The New York Times – this will kneecap their growth prospects

Energy

Tesla’s secret team to suppress thousands of driving range complaints | Reuters – Tesla years ago began exaggerating its vehicles’ potential driving distance – by rigging their range-estimating software. The company decided about a decade ago, for marketing purposes, to write algorithms for its range meter that would show drivers “rosy” projections for the distance it could travel on a full battery, according to a person familiar with an early design of the software for its in-dash readouts. Then, when the battery fell below 50% of its maximum charge, the algorithm would show drivers more realistic projections for their remaining driving range, this person said. To prevent drivers from getting stranded as their predicted range started declining more quickly, Teslas were designed with a “safety buffer,” allowing about 15 miles (24 km) of additional range even after the dash readout showed an empty battery, the source said – fundamentally dishonest

Finance

China’s biggest mobile payment platforms now accept VISA & Mastercard | Pekingology

FMCG

Six Bubble Tea Chains Plan IPOs in Bet on China Consumer Revival – Bloomberg – Firms with fast franchise growth not allowed to list onshore. Mixue, ChaBaiDao, GoodMe among firms weighing listings. Who is to say that these businesses won’t be like Luckin Coffee? If the Chinese government won’t allow them to list at home and they don’t want to list in Hong Kong, one has to wonder about the state of these businesses

Germany

German deindustrialization crisis of the day – Marginal REVOLUTION

Health

Case for using antidiabetic drug for anti-ageing strengthened after Hong Kong university studies genetic data from 320,000 Britons | South China Morning Post – expect this to blur the line between health and beauty or aesthetic treatments

‘Catastrophic’ forecast shows 9m people in England with major illnesses by 2040 | The Guardian

A couple of things about this video. Major Australian TV network asked YouTuber ColdFusion to make this documentary. YouTubers are now competing against TV production houses for production briefs. Secondly, the video offers a positive take on how machine learning may impact healthcare.

Hong Kong

Charged with one crime, convicted of another: how one baffling rioting conviction exposes Hong Kong’s broken courts – is it wrong, yes. Is a break from common law? I am less sure, just because a court procedure is unusual, such as inviting the prosecution to submit a new charge instead isn’t necessarily a breach. What it does mean is that all litigants need to be wary of going to court in Hong Kong given how unorthodox practices are likely to spread.

60 Minutes Australia on Hong Kong’s awards for capturing dissidents.

Hong Kong’s Hard Line Against ‘Soft Resistance’ | Asia Sentinel – Hong Kong’s analogue of the mainland’s historical nihilism. And concern about ‘soft resistance’ abroad: Has ‘soft resistance’ spread to the UK? | Big Lychee, Various Sectors

Innovation

EssilorLuxottica to move into hearing aids after buying Israeli start-up | Financial Times

Japan

Manga is the Rock ‘n’ Roll of Gen Z – on Shonen Jump magazine

London

How to find Britain’s stolen Rolexes? Bring in the flying squad | The Sunday Times – London is taking a reputation hit due to high crime level against travellers and the more wealthy. It will affect the travel and hospitality sectors, auctions, luxury retail and even

JustoffJunction.co.uk – genius app for planning British motorway travel, the reason why you would care would be the inflated prices at motorway services stops

Luxury

Gucci Joins Forces With Christie’s To Disrupt the Art and Fashion Market Through Generative AI – Jing Culture & Crypto – generative AI displaces metaverse as Kering’s technology trend du jour

Security

The pushback against industrial policy has begun – Noah Smith rebuts The Economist’s recent article against reindustrialisaton of the west.

Thales/Imperva: cyber security deal boosts defence group’s best division | Financial Times

Software

Transformers: the Google scientists who pioneered an AI revolution | Financial Times

Taiwan

How China’s military is slowly squeezing Taiwan | Financial Times – great read

Technology

TSMC sees headwinds, flips to 10 percent decline forecast | EE News Europe

Samsung reportedly investing in R&D for 3D stacking GAA technology