There is a bigger argument to be made about generations versus life stages for marketers, but generation X does have some shared life experiences that define them. In much the same way that the baby boomers were defined by the Apollo programme, the Cultural Revolution and the Kennedy assassination. 50 ways that you know you are generation x based on the following live experiences, in no particular order:

- You were afraid of a hole in the ozone layer before climate change became the new green cause

- You hear the word portal and think of an early website with a cluttered layout like a broadsheet newspaper from companies like MSN, Yahoo! and Excite rather than a round window with a nautical theme or the PC game

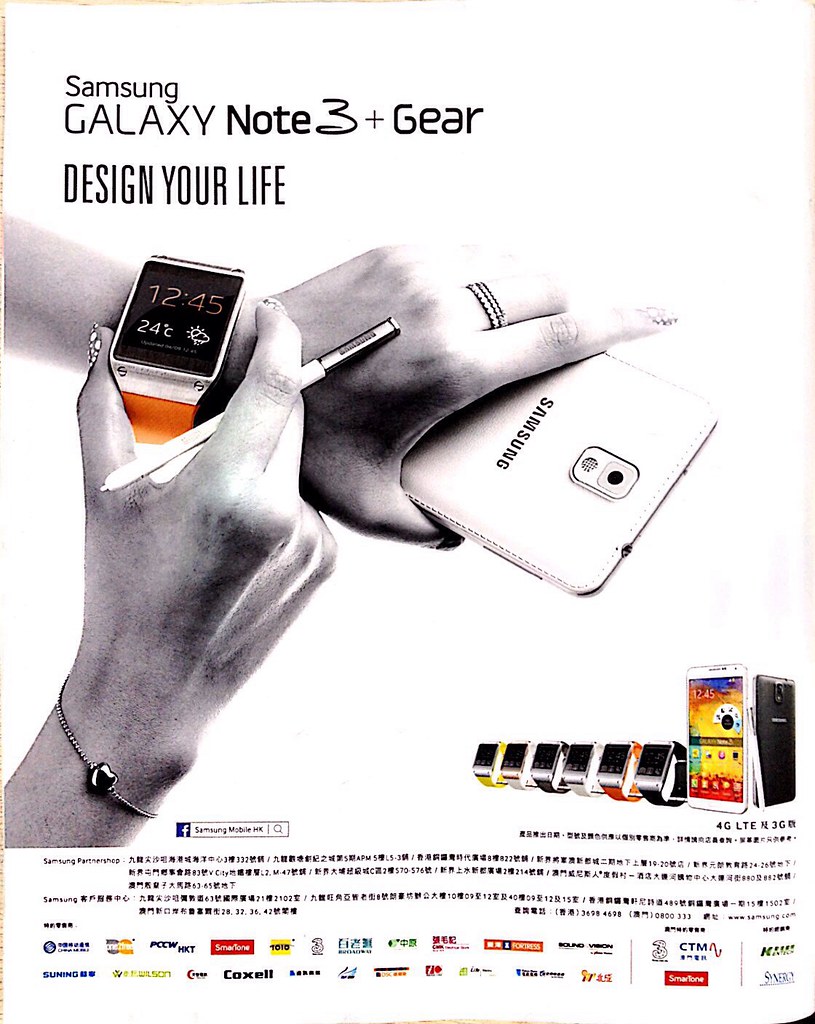

- You can remember when your cellphone was smaller than your current iPhone

- You can remember feeling sad when the local HMV | Tower Records | Fopp closed down

- One of your coolest friends worked behind the counter in an independent record or comic shop

- Bill Gates is the ex-CEO of Microsoft, not a global do-gooder

- You can remember when Sony and Nokia were cool

- Morrissey is up there with Plato

- The M in MTV stood for music

- You can remember when the Argos catalogue was a cornucopia of consumerism

- You remember reading American Psycho and sharing which page you were able to read up to with friends before having to give up on the book

- The first time you heard of Calvin Klein was as a punchline in Back To The Future

- You still call a Snickers bar a Marathon on occasion, ditto Starburst and Opal Fruits

- You ‘got’ the Rutger Hauer Guinness adverts

- There weren’t comedians before alternative comedians like Ben Elton

- You can remember when watching TV meant four or less channels

- You can remember the wonder of the internet before the spam became overwhelming

- When you see Guy Pearce in a film, you still think of his character Mike Young; a friend of Scott and Charlene in Neighbours

- You were blown away by the first series of This Life; it really spoke to you, even the one off reunion special they did years later

- The truth is out there still; Edward Snowden’s allegations sound like a plot from a lost series of the X-Files. In fact, the X in generation x might stand for X-Files (but it doesn’t)

- You find yourself asking when did Lego get so expensive?

- Hunting around the house on a Friday night for a C-90 cassette to record the essential mix. Bonus points if you clipped the playlist from

- You can remember the static build-up on the front of the TV when it had been on a while and then turned off and watching the dot in the middle of the screen fade to black in a darkened room like some impromptu nightlight

- You had considered booking a last minute getaway in Spain at some point because of the amazing offer you had found on Teletext

- Everyone you knew had Dire Straits Brothers in Arms in their CD collection, even if they hated Dire Straits. There was some dark conspiracy involving black helicopters which how the discs made their way into every home

- You owned a ‘Groover’ Hoover logo t-shirt at some point

- You’ve had someone come up and offer you money for your decade old Adidas Superstar reissues from the early noughties

- You customised your instant messenger client with AIM buddy icon packs that brands used to provide as a download alongside with screensavers and wallpapers. My personal favourite was the swirling cow in the tornado offered as a free download to promote Twister when it was released at the cinema

- You’ve owned an Ericsson mobile phone

- You can remember when petrol stations sold four-star leaded petrol, older people can even remember the five-star leaded petrol that stopped being sold sometime after the 1973 OPEC oil embargo

- You wore a Swatch watch and thought it was cool, you may have even splurged for a Swatch internet time (@time) watch later on

- You’ve got the original 1994 version of Renaissance: The Mix Collection by Sasha and John Digweed. You may even point out by how the 2004 re-master of the album was ruined since it no longer features the Qat Mix (by Sasha) of M-People’s How Can I Love You More? If you actually went to Renaissance at the Venue 44 in Mansfield you are probably hoping blurry photos of you in a Versace shirt, leather trousers and a pair of Red Wing engineers boots never make it online

- You know the weak spot of Global Hypercolour t-shirts was the contrast coloured arm pits you got in the club

- You’ve used an AOL install CD as a coffee coaster. Fun fact, my Dad hung them on the apple tree he had in the garden and they were effective at scaring away birds who would otherwise peck the apples before they ripened

- You know Graffiti bonus geek points if you had attempted to use the Apple Newton handwriting system

- You paid (or dodged) poll tax

- You felt discriminated against by the government because of your love of repetitive beats

- You own a Ministry of Sound mix CD collection in a hard back book type case

- You used to read Select magazine

- You’ve used Wella Shockwaves ‘wet-look styling gel’

- You tried to get a Magic Eye poster to work but all you saw was a fractal mess

- You bought a copy of NME with a flexi-disc on the front

- The first Tolkien film you’ve seen was Ralph Bakshi’s animated version of The Lord of The Rings

- You can remember when the first McDonald’s opened in your town and served root beer. Secondly, when you asked for a Coke you were told ‘that’s McDonald’s cola’

- Bod, Auntie Flo, PC Copper, Frank the Postman, Farmer Barleymow, Alberto Frog and his Amazing Animal Band – need no explanation

- You liked the Beastie Boys before their seminal Paul’s Boutique album

- Audio on the move meant Walkman and a selection of carefully curated mix cassettes

- The line ‘Get on down and party’ meant that you had caught the opening credits of Dance Energy with Normski

- It’s still weird catching Janet Street-Porter of ‘yoof TV’ fame on Loose Women whilst channel-hopping

- You’ve used a television without a remote control

What other ones do you think are missing from this list of generation X experiences?