April 2024 newsletter introduction

Welcome to my April 2024 newsletter which marks my 9th issue. We managed to make it through the winter and the clocks moved forward allowing for lighter evenings in the northern hemisphere.

The number nine is full of symbolism in a good way. In Chinese culture it sounds similar to long-lasting. It was strongly associated with the mystical and powerful nature of the Chinese dragon. From the number of dragon types and children to the number of scales on the dragon – which were multiples of 9. You have nine channels in traditional Chinese medicine. In Norse mythology there are nine worlds and Odin the all-father hangs on the tree of life for 9 days to gain knowledge of the runes.

Social media-related cognitive dissonance

A couple of conversations with people, spurred me to write this next piece.

I know it’s obvious and common sense, but it needs to be said occasionally. This time last year, I was on a Zurich work trip, providing support to a teammate running a workshop for a client who viewed the agency as the least worst option. We did good work and built temporary rapport, we got insight about the wider client-side politics at play. It was the classic example of the complexities involved in agency life and Lord knows we already have enough internal politics in our own shops to deal with.

The photo I shared on Instagram at the time gave no clue to what was happening, serving as a reminder to consider the curated nature of social feeds when scrolling through.

New reader?

If this is the first newsletter, welcome! You can find my regular writings here and more about me here.

Things I’ve written.

- Fads versus real trends

- A quick guide to jargon used in pharma marketing.

- What my answers to Campaign’s a-list questions would look like.

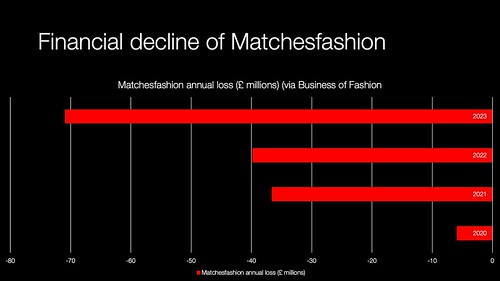

- Boutique e-tailers and why the multi-brand luxury retail sector has gone from boom to bust.

- Very Ralph and other things – Ralph Lauren’s world building abilities and how others from a cancer patient or overseas migrant workers have bent the world to their needs, or made a new one.

Books that I have read.

- There are a few books that I revisit and the March 1974 JWT London planning guide is one of them. In many respects it feels fresh and more articulate than more modern tomes.

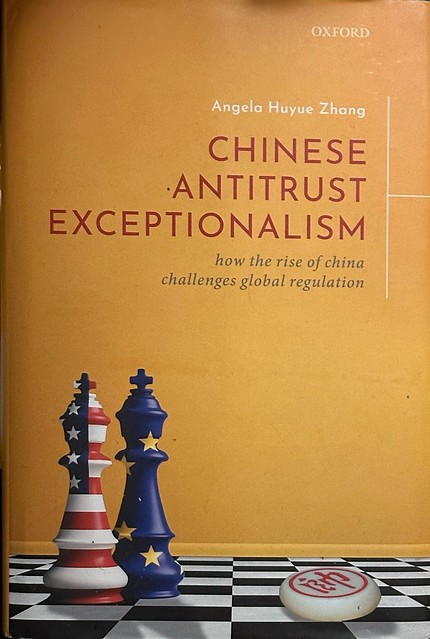

- Chinese Antitrust Exceptionalism by Angela Zhang sounds exceptionally dry to the uninitiated. But if like me, you’ve worked on brands like Qualcomm, Huawei or GSK you realise how much of an impact China’s regulatory environment can have on your client’s success. Zhang breaks down the history of China’s antitrust regulatory environment, how it works within China’s power structures and how it differs from the US model. What becomes apparent is that Chinese power isn’t monolithic and that China is weaponising antitrust legislation for strategic and policy goals rather than consumer benefit. It is important for everything from technology to the millions of COVID deaths that happened in China due to a lack of effective vaccines. Zhang’s book won awards when it first came out in 2021, and is still valuable now given the relatively static US-China policy views. Given the recent changes in Hong Kong where she lives, we may not see as frank a book of its quality come out of Hong Kong academia again on this subject matter.

- Van Horne and Riley’s Left of Bang was recommended by a friend who recently left military service. It codified and gave me a lexicon for describing observations of focus group dynamics and observation-based shopper marketing. Probably of bigger value to people more interested in the analytical side of behavioural science is the bibliography – which is extensive.

Things I have been inspired by.

Sustaining a sustainable brand

Kantar do a good webinar series called On Brand with Kantar. I got to watch one of them: Why consumers ignore brands’ sustainability efforts. Consumers are reticent to trust in brand’s sustainable efforts. Kantar’s recommendation is to stay the course and continue to demonstrate real sustainability. Kantar’s work complemented System 1’s Greenprint US-orientated sustainable advertising report. There is a UK-specific version as well with half a dozen ideas for marketers published in partnership with ITV.

Media platform trends

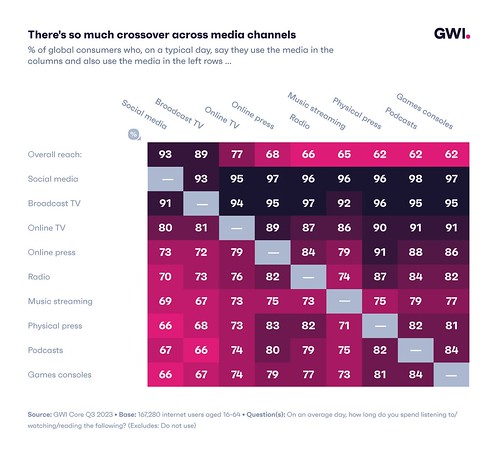

GWI released their 2024 Global Media trends report. GWI takes a survey based approach to understand consumer media behaviour.

- Broadcast TV still commands the greatest share of total TV time, despite Netflix, Amazon Prime Video and a plethora of other streaming platforms from Criterion to Disney+.

- Survival/horror players are most excited about gaming luxury collabs, whether or not luxury brands are equally excited about survival or horror gamers is a bigger question.

- Games console ownership has halved in the past ten years. This surprised me given how many of my friends have a Switch or PlayStation 5. It probably explains why Microsoft is focusing on being a publisher rather than on platforms as well.

Japanese online media spend

Dentsu published a report looking into 2023 Advertising Expenditures in Japan. A couple of interesting outtakes.

- They focused exclusivity on internet advertising, which gives you a good idea on where they want the balance of media spend to go, rather than necessarily the right tool for the right job. Yes digital is very important, BUT, we live in a world were we are wrapped by and consume layers of digital and analogue media.

We can see from GWI data that this viewpoint is likely to be still excessively myopic in terms of media due to offline – online media linkages. This is likely to be even more so in Japan that still has a more robust traditional media industry.

- Internet advertising reached a new high, despite being a couple of years after the Olympic games were hosted in Tokyo. (Media spend when a country hosts the olympics tends to be skewed that year upwards).

One thing I would flag is that this report is based on surveying people across the Japanese advertising industry and built on their responses. So there maybe some biases built into that process. Overall it’s a fascinating read.

Social media engagement benchmarks

RivalIQ published their 2024 Social Media Industry Engagement bench report, download it to get the full details. Three things that struck me straight away:

- Macro-level decline across platforms on engagement rate, which matches the trends that Manson and Whatley outlined ten years ago in their Facebook Zero paper for Ogilvy Social.

- If brands didn’t need enough reason already to reduce exposure to Twitter, the falling engagement rates on the platform add additional reasons. Overall video seemed to underperform on engagement compared to photos.

- One thing leaped out to me in the industry verticals data, if you are looking to reach student age adults, why not consider collaborating with higher education institution social media accounts rather than influencers?

Shocking health outcomes

The Hidden Cost of Ageism | A Barrier to Innovation & Growth | Future Work – sparked a lot of discussion with its implications on workplace practices, particularly within the advertising sector. What was less discussed but more important was the implications of ageism related biases on healthcare treatment.

Under-treatment or Over-treatment: Older adults may receive less aggressive treatment options or are overtreated because of age-related biases, rather than based on individual health needs and preferences.

Dismissal of Concerns: Healthcare providers might dismiss older patients’ health issues as inevitable parts of ageing, potentially overlooking treatable conditions.

Age-Based Prioritisation: In some cases, age influences the allocation of healthcare resources, with younger individuals being prioritised over older ones, assuming they have more “life worth living.”

The Hidden Cost of Ageism | Future Work

MSNBC News in the US did a report on what it called a ‘Post-Roe underground’ echoing the underground railroads to free slaves in the Southern states and the Vietnam war era draft dodgers who escaped north to Canada. This time it is to help women access abortion pills or procedures in other states or Mexico.

My friend Parrus hosted a talk on World Health Day, more on that here, the key takeaway for me was not trying to replicate developed market solutions in developing markets. Instead think about how it could be reinvented. Thinking that could be extended beyond health care to consumer goods, telecoms and technology sectors as well.

Luxury market shake-up

Business of Fashion covered a US court case where two women brought a lawsuit against Hermès, alleging purchase of its sought-after Birkin bag is dependent on purchase of other products and is an “illegal tying arrangement” that violated US antitrust law.

Hermès is more vulnerable than other brands because it owns its retail stores. The case, if successful could have implications far beyond the luxury bag-maker. For instance, how Ford selected prospective owners for its GT-40 sports cars, or most Ferrari limited edition for that matter.

While we’re on the subject of luxury, LVMH are rerunning their INSIDE LVMH certificate which is invaluable for anyone who might work on a luxury brand now or in the future. More here.

Morizo

Toyota are on a tear at the moment. They correctly guessed that electric cars were too expensive at the moment and focused hybrids as a stepping stone to electric and hydrogen fuel cell production. They have also successfully use the passion for driving in their products and their marketing. The Toyota GR Yaris was a result of Chairman Akio Toyoda instructing engineers to make something sporty enough to win the World Rally Championship and affordable.

He also outed himself as a speed demon who went under the nom de plume of Morizo.

Quebec

For many English speakers one of the most dissonant experiences is being confronted by a language you can’t speak. It’s part of the reason why ireland managed to become the European base of companies like Alphabet and and Intel. So I was very impressed by this campaign by the Quebec government to attract visitors and inbound investment.

Things I have watched.

I watched Mr Inbetween series one in March and managed to work through series two and three this month. I couldn’t recommend them highly enough as a series. They just keep building on each other.

Over Easter, I revisited some old VHS tapes my parents still had and rediscovered the Christopher Walken science fiction horror film “Communion.” It epitomizes its era, with alien abduction narratives emerging during the Cold War and permeating popular culture from “Close Encounters of the Third Kind” to “The X-Files,” tapering off after 9/11. “Communion” demonstrates how effective editing and minimal special effects can heighten tension and emotion. Despite the film’s incredulous premise, Walken delivers a fantastic performance.

“Modesty Blaise” is from a time when comic book adaptations were uncommon in cinemas. This 1966 adaptation of the 1960s comic strip shares stylistic similarities with “Barbarella” and stars a young Terence Stamp. I received a tape copy from a friend who was attending art college at the time. The depiction of the computer as a character with emotional reactions in the film feels contemporary, echoing the rise of virtual assistants like Siri and ChatGPT, despite being portrayed as a mainframe. It is interesting to contrast it with Spike Jonze’s movie Her made 50 years later.

Useful tools.

A lot of the tools this month have been inspired by my trusty Mac slowly dying and needing to get my new machine up and running before my old machine gave out.

Time Machine

Apple’s native backup software, Time Machine, serves as a personal sysadmin for home users. Regular backups are essential. If a crucial document disappears while you’re working on it, Time Machine, coupled with a Time Machine-enabled hard drive, allows you to retrieve earlier versions of the document, potentially saving your sanity in critical moments.

Microsoft Office

I prefer the one-off payment model over Office 365 services. I use Apple’s Mail, Contacts, and Calendar apps instead of Outlook. While Office is available for just £100, which is reasonable considering its features, I still prefer Keynote over PowerPoint for creating presentations.

Superlist

Many of you may recall Wunderlist, which Microsoft acquired, but much of its original charm was lost in the transition to Microsoft To Do. Superlist is a reboot of Wunderlist by the original team, this time without Microsoft’s involvement. It’s available on iOS, macOS, and the web, catering to both individual and team task management needs.

ESET Home Security Essential

I used to rely on Kaspersky, and while I generally like their products, I have concerns about the potential influence of the Russian government. Therefore, I switched providers. ESET has a strong reputation and offers better Mac support than F-Secure. I can recommend their ESET HOME Security Essential package.

Amazon Basics laptop sleeve

I use a various bags depending on my destination and activities. Over the years, I’ve found that Amazon Basics brand laptop sleeves work well for my machines. They’re often among the cheapest options available and tend to outlast the computers they protect.

Laptop camera cover

The photo of Mark Zuckerberg’s laptop with tape covering the camera raised awareness about privacy. Webcam privacy covers, such as a sliver of plastic that slides across, are ideal as they allow your laptop to close fully. A pro tip is to use a red LED torch to clearly locate your camera when applying the stick-on cover.

Protective case and keyboard cover

I’m a big fan of clip-on polycarbonate shells to protect my laptop, as they provide a better surface for the stickers that personalize my machine over time. You don’t necessarily need a big-name case. The one I have came with a keyboard cover that works well. Anything that prevented Red Bull, coffee, or croissant flakes from getting under my keys is worth doing.

Screen protector film

The screen protector film provides great protection and is easy to apply and clean, even for beginners like me. I’ll update you if my opinion changes.

The sales pitch.

I have enjoyed working on projects for PRECISIONeffect and am now taking bookings for strategic engagements or discussions on permanent roles. Contact me here.

More on what I have done here.

The End.

Ok this is the end of my April 2024 newsletter, I hope to see you all back here again in a month. Be excellent to each other and enjoy the bank holiday.

Don’t forget to like, comment, share and subscribe!

Let me know if you have any recommendations to be featured in forthcoming issues.