19 minutes estimated reading time

Nokia Microsoft deal

In the week since the news broke my thoughts on the acquisition by Microsoft of Nokia’s device business have slowly coalesced into the notes that make up this post.

The two Nokia’s

The acquisition is a tale of two businesses, the first business is a business services, cloud computing and network hardware business: HERE maps (Naviteq) and Nokia Siemens Networks. This business has improved as many of the major developed world markets have expressed concern over Huawei and ZTE infrastructure. It depends on having high-quality, high touch relationships with the world’s wireless telecoms businesses and internet businesses.

Of the two I suspect that Naviteq could be the most profitable because of the cost of gaining high quality up to date geo-location-based information that can be integrated into business support systems. Nokia’s infrastructure business faces a number of challenges:

- The high cost of research and development to remain at the table for fifth generation networks. This problem was exasperated as Nokia was on the wrong side of the WiMax/LTE battle

- They are in a field where there are other well established hungry western players (Alcatel-Lucent and Ericsson) and ‘safe’ Asian competitors (Samsung)

The other Nokia is the devices business that is more familiar to consumers; this is the Nokia Microsoft business now. Like the first Nokia I outlined this one too needs high quality, high touch relationships with carriers in countries where they represent the primary distribution channel. In developing markets with high pay-as-you-go phone usage the channel partner structure maybe more complex; and I haven’t even discussed the grey market channel yet which makes up to 80 per cent of sales in some countries.

The relationship with carriers is wrapped up in technology choices and Nokia’s handset business was adversely affected in two ways:

- A number of carriers including NTT DoCoMo and China Mobile had bought into Symbian as an operating system and had actively supported it in their products. NTT DoCoMo had contributed to the Symbian stack and bought phones from the likes of Panasonic that ran SymbianOS S60

- Nokia had successfully got a number of carriers including China Mobile on board with its future internal operating system MeeGo

The Nokia Microsoft pivot was sudden and burned bridges of trust that would take time to rebuild. Secondly Symbian S60 and to a lesser extent MeeGo encouraged consumers to use a phone as a phone; they were designed with a design philosophy from the ground for both voice and data usage. Android and iOS fall decidedly more towards being connected personal digital assistants (PDAs) that also make calls. From a user experience point of view there is not a million miles of separation between iOS, Android and the Treo range of Palm OS-based phones of the early to mid-noughties (guess where Apple got its ringer mute switch from).

Wireless carrier business models have been built around selling the convenience of being able to make voice calls whenever you want, data is a comparative latecomer to this business. The reason why mobile phones went to digital in the first place was to increase the network carrying capacity of voice traffic. A key benefit of 3G networks for carriers was not selling video clips like 3 first tried to do but efficiently carrying voice traffic as most people of secondary school age or above had a mobile phone.

So having an operating system that puts a universal VoIP (voice over IP) client at the centre of its offering is not going to win any friends. Microsoft acquired Skype in April 2011 and has progressively put the VoIP client at the centre of its messaging offering and phone software.

Secondly, Microsoft’s record of mutually beneficial success in the PC industry, portable computing industry and telecoms sectors features a list of troubled companies. Specifically in the telecommunications sector:

- Nortel – Microsoft and Nortel formed the Innovative Communications Alliance in June 2006 that was focused on unified communications within enterprises (the use of VoIP PBXs would facilitate video, conference and phone calls without paying phone charges to carriers for multinational companies). Three years later Nortel is broken up into pieces and sold off. The reasons for this were legion: the company had been hacked for years and was a victim of industrial espionage on an epic scale, the company had been over-exposed to the telecoms bubble of the late 1990s through its sale of optical equipment. One of my clients at the time RSL Communications had a backbone network based on Nortel optical equipment. It’s ubiquity left the business exposed. Mismanagement that led to a number of restatements of the company accounts with over-valued assets and under-valued liabilities

- Motorola – Though one tends to think of the RAZR feature phone and the Android phones (pre-and-post Google acquisition); Motorola had taken a number of smartphone attempts. It had built the first smartphone based on Linux running Java applications back in 2003, which had proved to be very popular in China due to it’s handwriting interface. It had also been a part of the Symbian alliance and had used the UIQ interface favoured by Sony-Ericsson. It had even licensed the Palm OS and had an early device in development by 2001. However at the critical time around the launch of the original iPhone Motorola had a Microsoft Windows Mobile-powered smartphone the Motorola Q. That worked out sufficiently well that Motorola abandoned it and focused on Android devices. The company was eventually acquired by Google as much as a defensive move to protect the Android eco-system from Motorola patent suits as much for the handset manufacturer’s business

- Palm – Palm was founded in 1992, they originally created a device called the Zoomer in partnership with Casio and Tandy – who provided the manufacturing and supply chain whilst Palm built the personal information manager (PIM) software. The operating system came from Geoworks, who also made the operating system for the original Nokia Communicator devices. The Zoomer was not a financial success but Palm did manage to sell synchronisation software to Hewlett-Packard and handwriting recognition software to Apple for the Newton range of PDAs. The company was acquired in 1995 and released the Palm-Pilot range of devices in 1997 running the Palm OS that had been developed the previous year. The Pilot 1000 and 5000 were replaced by the Personal and Professional – around about this time the devices were also sold with a basic dial-up modem providing stand-alone connectivity. The year 2000 saw Palm at the top of its game with the launch of the Palm V and the company being floated by parent 3Com on the NASDAQ; though the dot com crash saw its valuation drop by 90 per cent in a year. Palm has its first smartphone the Treo 180 acquiring Handspring. The Treo series of smartphones did well in North America and proved a viable alternative to the BlackBerry for many people. I had the Treo 600 and then the 650 from 2004 to 2007. Soon after this Palm started using Windows Mobile on some of its devices and this occurs around about the time that the business past its peak, prior to the strategic investment by Elevation Partners and sale to Hewlett-Packard

- Sony-Ericsson – Sony Ericsson started with an unpromising origin. Ericsson’s mobile phone business had been crippled by a fire at a supplier in 2000, so it sold a share in the business to Sony who had been on the sidelines of the mobile industry despite some early successes with the Sony CM-H333 in 1993. Sony struggled to deal with the change in market brought about by the first iPhone. The company used Windows Mobile for its Xperia phones for two years. Eventually Sony-Ericsson moved over to Android in March 2010, the company has struggled to remain relevant in the mobile market, but has made headway with Android

- Sendo – was a start-up founded in 1999, they signed an agreement with Microsoft to be the company’s go-to-market partner for their Smartphone 2002 mobile operating system. The deal gave Microsoft a royalty-free license to Sendo’s designs if the company went insolvent. There was a legal dispute when Microsoft used Sendo’s designs to create the first of the Orange SPV phones made by HTC. Sendo rolled out Symbian handsets and cancelled its Microsoft-powered devices. Microsoft eventually settled out of court with Sendo, relinquished their shareholding in the company and Motorola eventually absorbed the business and intellectual property. However the the company name became a by-word within the industry damning Microsoft

- LG – In late 2008, the Korean chaebol signed an agreement with Microsoft that focused on a strategic collaboration on mobile technology, which was widely expected to mean Windows Mobile phones. The mobile devices unit suffered continued losses, eventually in February 2013 LG said that there was no demand for Windows Phone devices and moved its portfolio exclusively over to Android where it competes with a respectable performance against Samsung

All of this means that the Nokia device business hasn’t been a master of its own destiny since the company launched its transformation almost three years ago.

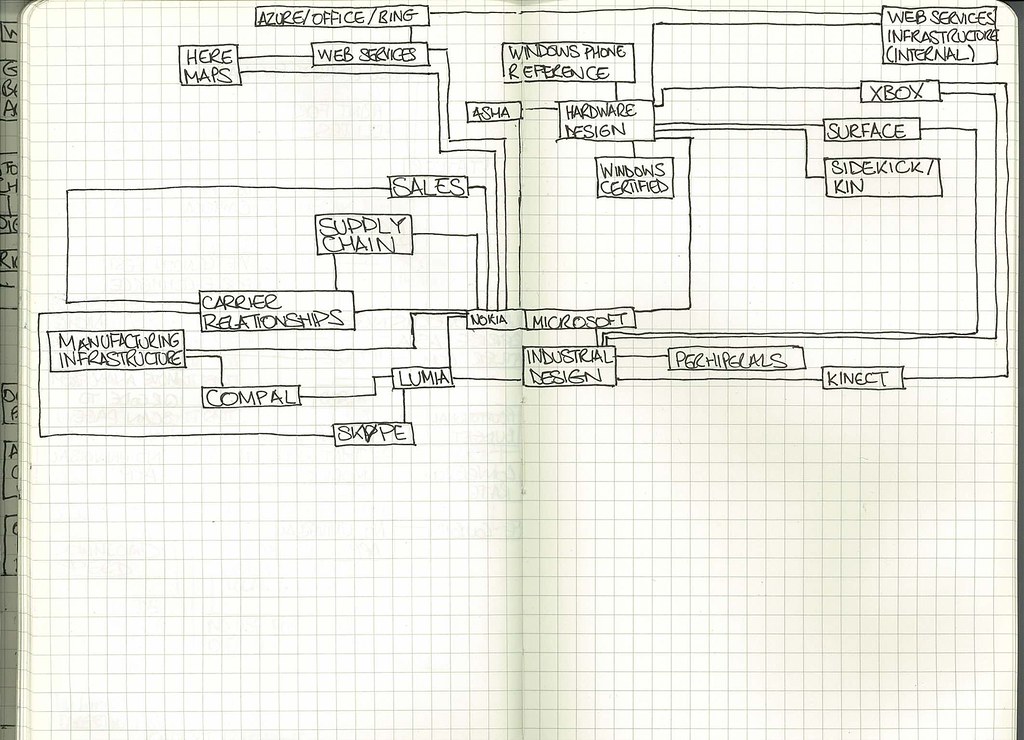

What is Microsoft actually buying?

I remember once talking with a friend of mine who had worked on the Microsoft account for along time and they once told me that Microsoft never buys something that it can build more cheaply itself. Which then brings me to four questions:

- So what does Nokia have that Microsoft wants?

- What does Microsoft currently have?

- What would Microsoft with Nokia have, that neither party currently has?

- How is Microsoft paying for the deal?

What does Nokia have that Microsoft wants?

Nokia historically was strong because of it’s brand. I did a quick search on Google Trends to get some sort of proxy comparison on the relative strengths of different brands and in the data you can see that Nokia Lumia and Nokia Asha have a higher level than Windows Phone or Microsoft Surface.

Secondly the Nokia brand on its own is still hugely dominant compared to Microsoft’s other mobile brands. To get that kind of brand profile would be very expensive for Microsoft, but more importantly would take time that the company doesn’t feel that it has.

Nokia had manufacturing prowess, the Nokia Asha handsets have a quality that generally belies their price. The move over to the Lumia left lots of Nokia’s production lines quiet and their supply chain for the factories wasn’t as useful as Lumia used different suppliers and designs for many of the major components. For instance the processor in the Lumia range is a Qualcomm Snapdragon, where as Nokia’s Symbian and MeeGo handsets used Texas Instruments OMAP processors.

In the end Nokia contracted out Lumia production (at least initially) to Compal. Microsoft has its won relationships with OEMs and ODMs in order to manufacture sophisticated hardware like the Microsoft Kinect.

Nokia along with Samsung has one of the most extensive sales networks in the world for mobile devices. However the company has been scaling this back as a cost-cutting measure as it tried to transition to a smaller size business during its move to Windows Phone. This has been partly driven in China by the collapse in market share that Nokia suffered during the transition. Microsoft saves time by building on the existing sales network put in place by Nokia.

Nokia historically had good carrier relationships, however the pivot and relationship with Microsoft have degraded these somewhat.

A legacy of the sales network and the carrier relationships is a body of knowledge about market differences, preferences, structures and price points with a greater degree of granularity than a report from the likes of IDC can provide. Much of this knowledge will be in the heads of key (but not necessarily senior) members of staff that Microsoft will have to identify and battle to retain in the coming months.

Nokia historically has had strong design capabilities based on a long history in terms of user research to thoroughly understand the customer use case. The polycarbonate Lumia design language was taken straight from the Nokia N9, and the 41 mega-pixel camera module first worked on Symbian but if some of the design team are still left Microsoft could have a positive asset on its hands.

Finally, Nokia has a lot of experience in working on nascent areas like mobile payments systems which offer the potential for massive revenues in the future.

What does Microsoft currently have?

Like Nokia, Microsoft has an extensive sales network and over the past few years has been expanding across sub-Saharan Africa. Whilst Microsoft has the physical presence it doesn’t necessarily have the right channel for mobile phones.

With a combined business, certain functions like finance and IT could be merged.

Microsoft has experience of sophisticated hardware design. The most lauded piece of design that Microsoft has done is the Kinect bar which is surprisingly sophisticated. It also designed the unsuccessful Kin device and the reference designs that all Windows-powered phones have to adhere to.

In terms of industrial design Microsoft has designed ergonomic peripherals for years. The hardware design if done right can be mated and optimised to the software design that Microsoft also creates.

Microsoft has a number of killer applications available for enterprise sales including business-grade email and personal information management, customer relationship management software and web search.

What would Microsoft with Nokia have, that neither party currently has?

If one looks at Apple’s products the reason why they work well is because of tight integration between software, services and hardware. Microsoft has alluded to this already, in a post-deal interview with C Net Joe Belfiore shed a little light on the fact that Nokia’s hardware designs weren’t aligned with software capabilities as Nokia tried to develop unique features.

There is also an implication that Nokia would move away the Microsoft mobile team from their US-centric behavioural thinking on issues like Bluetooth sharing of content.

The second theme that seems to come out is one of speed to act in order to catch up with rival ecosystems and gain competitive advantage. With the Nokia brand Microsoft gets a massive lift in terms of mobile brand awareness in emerging markets. However in order to take advantage of this lift and other performance advantages, Microsoft has to simultaneously and successfully integrate Nokia into the business.

It is an extra 30 per cent of employees compared to the pre-deal Microsoft. Normally this would be a difficult task, but this is also a Microsoft that is under attack from activist shareholders, looking for a new CEO to replace Steve Ballmer and aligning based on a reorganisation to a function structure.

Will Microsoft be able to retain the key people at Nokia with the relevant knowledge and be nimble in execution? When I was at college I was told by a professor that seven in every ten takeovers fail to achieve the goals set for them.

How is Microsoft paying for the deal?

On the face of it I was surprised to see that Microsoft was paying all cash for the deal, rather than issuing stock. The company has a good cash pile and doesn’t need to borrow, but printing shares wouldn’t have cost anything. It’s the way that Cisco financed its run of purchases through and after the dot.com boom.

The reality is that the US tax payer is indirectly paying for the deal. Microsoft like Apple has a vast amount of its cash flow sat offshore that they don’t want to repatriate due to US tax law.

In reality, Microsoft paid closer to 5 billion Euros than 7.2 because of the tax avoidance benefit in the transaction. Secondly, losses in Nokia can be written off against U.S. tax obligations.

The value judgement on whether Microsoft has over or under-paid will inevitably be coloured by the destruction of shareholder value at Nokia, which has been enormous both in terms of the monetary sums involved and in the decline of Nokia’s contribution to the Finnish economy and stock market. The second factor to colour the discussion is the likely discount Microsoft shares have as a conglomerate. There are various discussions elsewhere on the web about how Microsoft could realise more shareholder value by being broken down into ‘mini-Bills’. The Nokia acquisition is likely to intensify that discussion further, unless spectacular results can be demonstrated.

Nokia’s technological choices

Reflecting back on things, I was surprised by Nokia’s advocacy for WiMax given the telecommunications industry was moving forward with LTE – originally proposed by NTT DoCoMo back in 2004 and supported by TeliaSonera.This choice together with Nokia’s close relationship with Texas Instruments for device microprocessors steered a surprisingly large amount of Nokia’s recent decisions to date.

The thing that I found most interesting about Nokia’s device strategy pivot under Stephen Elop was the complete abandonment of Symbian S60 OS rather than the S40 OS that current powers their Asha-branded phones.

If one looks at the current range of Asha phones, Nokia has pulled and prodded the operating system to produce devices described as smartphones without an OS that has multi-tasking. They have even replicated the look and feel of Nokia N9 smartphone that ran MeeGo.

Nokia could have provided a smoother on-ramp and not upset so many carrier customers by moving S60 down the product line and brought Windows Phone in at the top. Instead they chose a riskier, more dramatic path. This affected carrier partners, the Nokia development community and Nokia users adversely. And this seems to have been a conscious decision by Nokia.

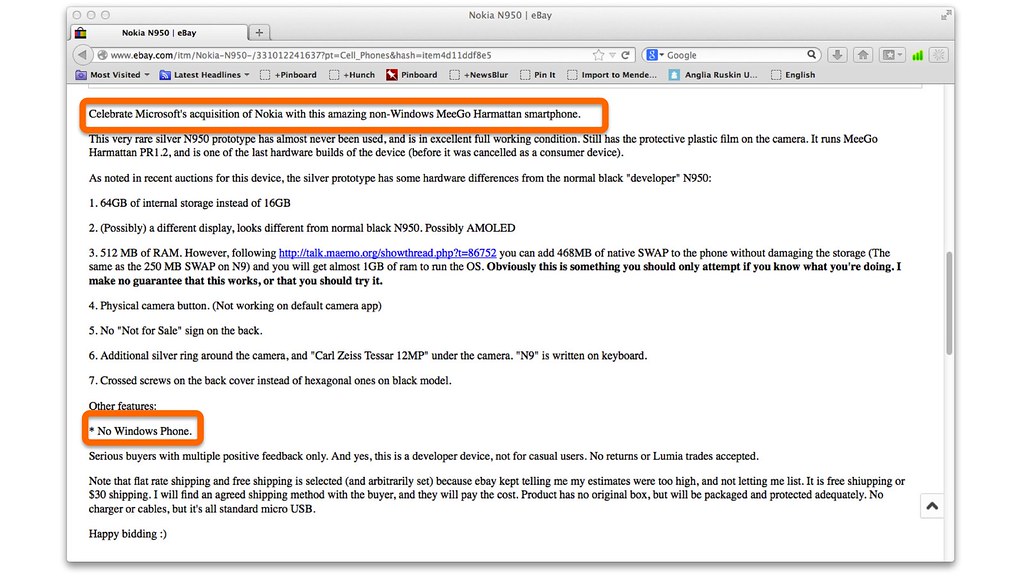

If one looks closely at this Nokia N950 offered for sale on eBay (presumably by one of the developer community):

One can see the kind of comment that shows an embittered developer relationship.

We will probably never know if they were boxed into this dramatic choice by Microsoft, but it seems to dialed the risk factor up even further.

Finally, the market performance of the Nokia N9 in markets were they were released showed a more mature looking product than the Lumia phones that were launched later. It made the Lumia range look bad and enraged critics by showing them what could have been.

Why did Microsoft leave so much on the table?

It was interesting that Microsoft just took a license to patents rather than full rights to Nokia’s patents. I think that this is a bet on Nokia taking a robust attitude to intellectual property licensing. Given that Nokia will be an infrastructure company it could now levy fees on the Android community (and possibly Apple) without consequence.

This would benefit Microsoft as it would increase the cost of rolling out Android devices, this potentially will give Microsoft room at the bottom end of the market for smartphones. Though I still think that they will be unable or unwilling to compete with the sub $70 per Android handset market segment which is driving smartphone growth in China.

Which begs the question is there an explicit agreement in place for Nokia to get litigious? Nokia would have to pick its foes carefully, for those players with both infrastructure and handset businesses like Samsung, Huawei and ZTE could be dangerous because of the likely patents they could use in retaliation.

If things get desperate Nokia could still sell these patents on to the likes of Intellectual Ventures.

The second item I was surprised to see Microsoft leave behind was Naviteq. The expertise in mapping would have been an asset to all of Microsoft’s business units.

Mobile would have benefited from having control over their mapping product, online services could look at doing further integration and alignment for consumer audiences. The enterprise part of the business could have used underlying data to help improve applications around customer relationship management (CRM), supply chain management and resource planning.

I imagine that this could have been for a few reasons:

- There aren’t that many companies that do what Naviteq does, being purchased by Microsoft may trigger antitrust concerns

- Naviteq needs a critical mass of users for its HERE maps to provide a decent product

- Microsoft can get everything they want without buying it

- It was a deal killer for Nokia who need the cash flow from Naviteq

What’s the catch?

- What does Microsoft see that it’s critics don’t in the Nokia business?

- Will Microsoft be thwarted by activist shareholders?

- What’s to stop Nokia pressing reset and starting another handset business by acquiring Jolla?

- Why will carriers want to engage with the newly enlarged Microsoft?

- Does Nokia have much of a long term future in infrastructure given the competitive landscape of Huawei and ZTE in developing markets and Samsung, Ericsson and Alcatel-Lucent in the more security paranoid western markets?

More information

Intel,China Mobile,LGE and Nokia Join MeeGo Handset TSG – Also companies for IVI and Smart TV | TizenExperts

EU regulators say telecoms block Skype | EurActiv

Most UK Mobile Broadband Users Could Swap Providers over Skype Blocks | ISP Review

Microsoft confirms takeover of Skype | BBC News

The story of Nokia MeeGo | Taskumuro

Microsoft excluded from DoCoMo’s ecosystem | The Register

Mobile leaders to unify the Symbian software platform and set the future of mobile free | NTT DoCoMo press room

Nortel and Microsoft Form Strategic Alliance to Accelerate Transformation of Business Communications | Microsoft News Center

Motorola to axe Palm smartphone | The Register

Microsoft’s masterplan to screw phone partner – full details | The Register

More LG Phones to Use Microsoft System | New York Times

LG | Communities Dominate Brands

Why Microsoft really bought Nokia | I, Cringely

Nokia confirms layoffs, pulls back sales channels in China | ZDNet

For Microsoft and Nokia, fewer secrets | CNet

More Nokia related content here.