5 minutes estimated reading time

At the end of January I wrote a blog post about the landmark luxe streetwear collection by Louis Vuitton and Supreme.

I delved into the history of streetwear and the deep connection it shared with luxury brands. This linkage came from counterfeit products, brand and design language appropriation.

This all came from a place of individuality and self expression of the wearer.

I reposted it from my blog on to LinkedIn. I got a comment from a friend of mine which percolated some of the ideas I’d been thinking about. The comment crystalised some of my fears as a long-time streetwear aficionado.

This is from Andy Jephson who works as a director for consumer brand agency Exposure:

The roots of street and lux that you point to seem to be all about individuality and self expression and for me this is what many modern collabs are missing. To me they seem to be about ostentatious showmanship. I love a collaboration that sees partners sharing their expertise and craft to create something original. The current obsession with creating hype however is creating a badging culture that produces products that could have been made in one of the knock-off factories that you mention. Some collabs that just produce new colourways and hybrid styles can be amazing, reflecting the interests of their audience. But far too many seem gratuitous and are completely unobtainable for the brand fans on one side of the collaborative partnership.

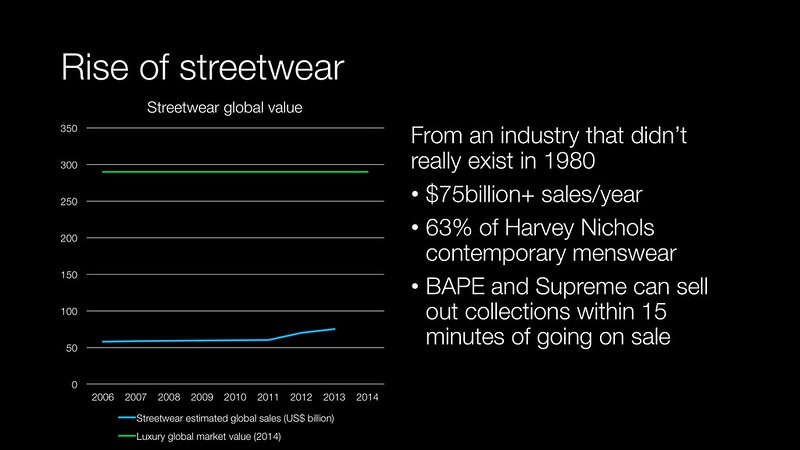

The streetwear business is mad money

From Stüssy in 1980, streetwear has grown into a multi-billion dollar global industry. Streetwear sales are worth more than 75 billion dollars per year.

By comparison the UK government spent about 44.1 billion on defence in 2016. Streetwear sales are more than three times the estimated market value of Snap Inc. Snap Inc., is the owner of Snapchat.

It is still about one third the size of the luxury industry. Streetwear accounts for the majority of menswear stocked in luxury department stores. Harvey Nichols claimed that 63% of the their contemporary menswear was streetwear. Many luxury brands off-the-peg men’s items blur the boundary between luxe and streetwear.

The industry has spawned some technology start-ups acting as niche secondary markets including:

- Kixify

- K’LEKT

- THRONE

- StockX

- SneakerDon

- GOAT

Large parts of the streetwear industry has become lazy and mercenary. You can see this in:

- The attention to detail and quality of product isn’t what it used to be. I have vintage Stüssy pieces that are very well-made. I can’t say the same of many newer streetwear brands

- Colour-ways just for the sake of it. I think Nike’s Jordan brand is a key offender. Because it has continually expands numbers of derivative designs and combinations. New Balance* have lost much of their mojo. Especially when you look at the product their Super Team 33 in Maine came up with over the years. The fish, fanzine or the element packs were both strong creative offerings. By comparison recent collections felt weak

- The trivial nature of some of the collaborations. This week Supreme sold branded Metro Cards for the New York subway

- Streetwear brands that sold out to fast moving consumer products. This diluted their own brand values. While working in Hong Kong, I did a Neighborhood Coke Zero collaboration. The idea which had some tie-in to local cycling culture and nightscape. Aape – the second-brand of BAPE did a deal wrapping Pepsi cans in the iconic camouflage

Hong Kong brand Chocoolate did three questionable collaborations over the past 18 months:

- Vitaminwater

- Nissin (instant noodles)

- Dreyer’s (ice cream)

By comparison, Stüssy has a reputation in the industry for careful business management. The idea was to never become too big, too fast. The Sinatra family kept up quality and selective distribution seeing off Mossimo, FUBU and Triple Five Soul. Yes, they’ve done collaborations, but they were canny compared to newer brands:

“The business has grown in a crazy way the past couple of years,” says Sinatra. “We reluctantly did over $50 million last year.”

Reluctant because, according to Sinatra, the company is currently trying to cut back and stay small. “It was probably one of our biggest years ever — and it was an accident.”

Sinatra characterises Stüssy’s third act as having a “brand-first, revenue second” philosophy, in order to avoid becoming “this big monstrosity that doesn’t stand for anything.”

The Evolution of Streetwear. The newfound reality of Streetwear and its luxury-like management academic study uncovered careful brand custodianship.

It’s not clothing; it’s an asset class

Part of the bubble feel within the streetwear industry is due to customer behaviour. For many people, street wear is no longer a wardrobe staple. Instead it becomes an alternative investment instrument. Supreme items and tier zero Nike releases are resold for profit like a day trader on the stock market.

Many of the start-ups supported by the community play to this ‘day trader’ archetype. It is only a matter of time for the likes of Bonham’s and Sotherby’s get in on the act.

A key problem with the market is that trainers aren’t like a Swiss watch or a classic car. They become unusable in less than a decade as the soles degrade and adhesive breaks down.

There is the apocryphal story of a Wall Street stock broker getting out before the great stock market crash. The indicator to pull his money out was a taxi driver or a shoe shine boy giving stock tips.

Streetwear is at a similar stage with school-age teenagers dealing must-have items as a business. What would a reset look like in the streetwear industry? What would be the knock-on effect for the luxury sector?

More information

USA Streetwear Market Research Report 2015 | WeConnectFashion

Louis Vuitton, Supreme and the tangled relationship between streetwear and luxury brands | renaissance chambara

New Balance Super Team 33 – Elements Collection | High Snobriety

New Balance ST33 – The Fanzine Collection | High Snobriety

1400 Super Team 33 (ST33) trio | New Balance blog – the infamous fish pack

How Stüssy Became a $50 Million Global Streetwear Brand Without Selling Out | BoF (Business of Fashion)

The Evolution of Streetwear. The newfound reality of Streetwear and its luxury-like management by de Macedo & Machado, Universidade Católica Portuguesa (2015) – PDF

* in the interest of full disclosure, New Balance is a former client.